When Black Friday Breaks Your Payment Flow

Your e-commerce platform just hit peak traffic during Black Friday. Orders are flooding in at 50,000 requests per second, but suddenly your payment success rate drops from 99.8% to 60%. Customers are abandoning carts, revenue is hemorrhaging, and your CEO is breathing down your neck. The culprit? Your payment system wasn't designed to handle the explosive growth that success brings.

Payment systems face unique scaling challenges that go beyond typical web applications. Unlike social media posts or search queries, every payment request carries real financial risk. A failed payment isn't just a poor user experience—it's lost revenue and potentially regulatory compliance issues.

Today's Learning Journey

We'll explore the critical architecture patterns that power payment systems at companies like Stripe, PayPal, and Square. You'll understand why simple load balancing isn't enough and discover the sophisticated patterns that ensure your payment flow remains rock-solid under extreme load.

By the end, you'll have built a working payment system that demonstrates these patterns and can handle realistic traffic spikes.

The Fundamental Scaling Challenges

Payment systems face three core scaling bottlenecks that traditional web applications rarely encounter. Idempotency enforcement becomes critical because duplicate payments create serious business problems. Unlike retrying a failed search query, retrying a payment without proper safeguards can charge customers multiple times.

State consistency across multiple processors creates the second major challenge. Modern payment systems integrate with dozens of payment processors, banks, and fraud detection services. Each integration point introduces latency and potential failure modes that compound as you scale.

Regulatory compliance under load represents the third challenge. PCI DSS requirements, transaction logging, and audit trails must remain intact even during traffic spikes that would normally justify cutting corners for performance.

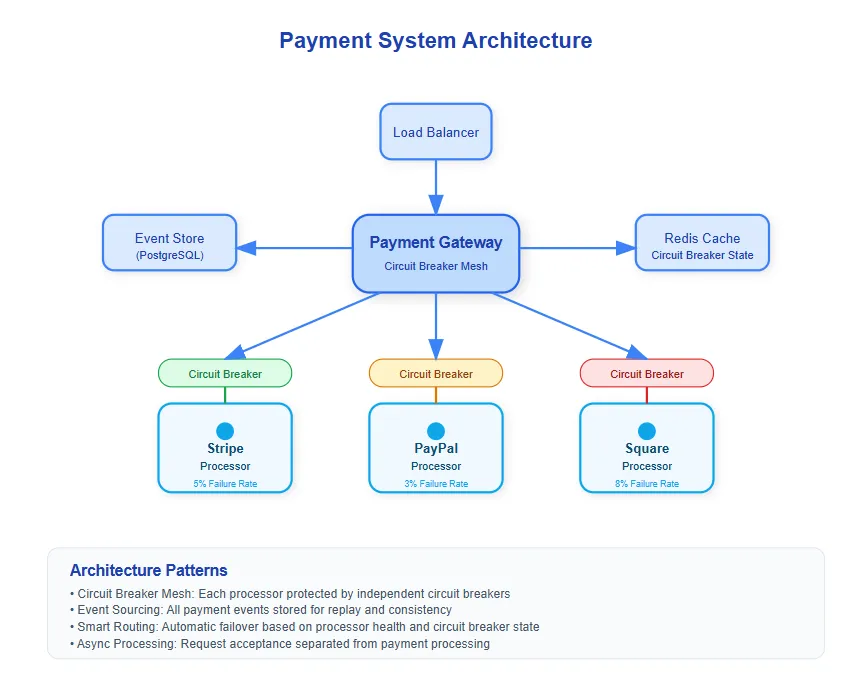

Architecture Pattern 1: Circuit Breaker Mesh

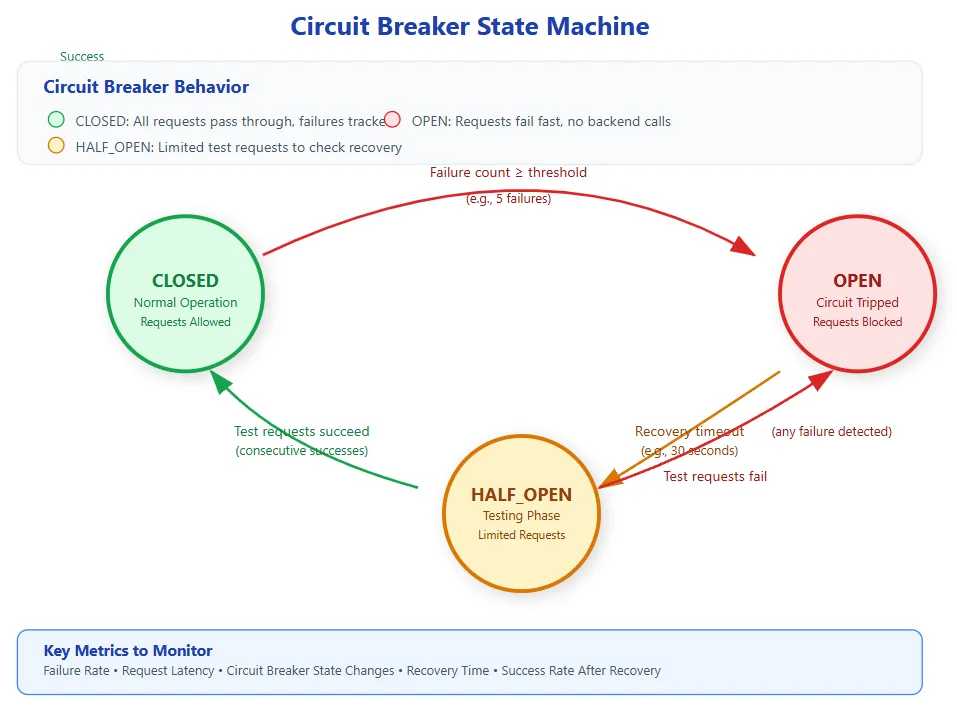

The circuit breaker pattern becomes essential when integrating with external payment processors. Unlike simple timeouts, circuit breakers learn from failure patterns and prevent cascading failures across your payment infrastructure.

Stripe's architecture implements a sophisticated circuit breaker mesh where each payment processor gets its own circuit breaker with processor-specific thresholds. When Visa's API becomes slow, the circuit breaker for Visa opens while Mastercard processing continues normally. This prevents one processor's problems from affecting your entire payment flow.

The non-obvious insight is that circuit breakers for payment systems need business-aware failure detection. A 5% error rate might be acceptable for a social media API, but for payments, even 1% errors represent significant revenue loss. Production payment systems use success rate thresholds as low as 99.5% to trigger circuit breaker activation.

Architecture Pattern 2: Async Processing with Event Sourcing

High-volume payment systems separate request acceptance from payment processing using event-driven architectures. When a payment request arrives, the system immediately returns a reference ID and processes the payment asynchronously. This pattern allows you to scale request handling independently from payment processing capacity.

Square's payment system processes over 2 billion transactions annually using this pattern. They capture every payment event in an immutable event stream, allowing them to replay payment flows for debugging and reconstruct payment state for any point in time. This approach also enables sophisticated retry mechanisms where failed payments can be retried with different processors without affecting the customer experience.

The architectural insight here is that event sourcing provides natural idempotency. Each payment attempt gets a unique event ID, making it impossible to accidentally process duplicate payments even during retry scenarios.

Architecture Pattern 3: Sharded Payment Processing

Geographic and processor-based sharding becomes crucial for global payment systems. PayPal processes payments differently across regions due to varying regulations, preferred payment methods, and processor availability. Their architecture routes European payments through different processor pools than Asian payments, with different fraud detection rules and compliance requirements.

The sharding strategy affects more than just performance—it impacts compliance and business logic. European payments must comply with PSD2 regulations, while Asian markets might require different fraud detection patterns. Smart sharding considers these business requirements alongside technical load distribution.

Real-World Implementation Insights

Netflix's billing system processes millions of subscription payments monthly using a fascinating hybrid approach. They pre-authorize payment methods during off-peak hours to validate cards and reduce payment processing load during peak viewing times. This "payment warming" strategy reduces the load on payment processors when customers actually make purchases.

Amazon's payment system implements dynamic processor selection based on real-time success rates. If Stripe's API is responding slowly, the system automatically routes new payments to Braintree or Adyen. This intelligent routing happens transparently to customers and maintains high success rates even when individual processors experience issues.

The critical insight from these implementations is that payment system scaling isn't just about handling more requests—it's about maintaining reliability and compliance while optimizing for business outcomes like conversion rates and transaction costs.

Advanced Patterns for Enterprise Scale

Canary payment processing allows you to test new processors or configurations with a small percentage of live traffic. When integrating a new payment processor, you can route 1% of payments through the new integration while monitoring success rates and error patterns. This reduces the risk of widespread payment failures during processor migrations.

Payment result caching with TTL-based invalidation helps reduce duplicate API calls to external processors. When customers refresh payment confirmation pages or mobile apps retry requests, cached results prevent unnecessary API calls while ensuring customers see consistent payment status.

Multi-region payment replication ensures payment data availability during regional outages. Critical payment state gets replicated across multiple regions with eventual consistency, allowing the system to continue processing payments even during major infrastructure failures.

Production Monitoring and Observability

Payment systems require specialized monitoring beyond typical application metrics. Revenue impact alerting triggers when payment success rates drop below thresholds that significantly affect business metrics. A 2% drop in payment success rate might seem small, but it can represent millions in lost revenue for high-volume systems.

Processor-specific dashboards track the health and performance of each payment integration separately. This granular monitoring helps identify which specific processors are causing issues and enables targeted troubleshooting.

End-to-end payment journey tracking monitors the complete flow from initial payment request through final settlement. This holistic view helps identify bottlenecks that might not be apparent when monitoring individual components in isolation.

Your Implementation Challenge

Build a distributed payment system that demonstrates these scaling patterns using our hands-on demo. The implementation includes multiple payment processors, circuit breaker protection, async processing with event sourcing, and comprehensive monitoring.

The demo simulates realistic failure scenarios including processor timeouts, network partitions, and traffic spikes. You'll observe how circuit breakers protect against cascading failures and how event sourcing enables reliable payment processing even during infrastructure problems.

This practical experience will give you the confidence to architect payment systems that can handle both planned growth and unexpected traffic spikes while maintaining the reliability that financial transactions demand.

Quick Demo

git clone https://github.com/sysdr/sdir.git git checkout payment_systems cd sdir/payment_systems ./demo.sh Open http://localhost:5173 ./cleanup.sh